The ingredients behind South Korea’s remarkable developmental success have been well-documented—macro stability, investments in basic education and applied research, export-orientation, and a public sector focused on achieving development targets.1 The engine of growth was driven mainly by a few privately-owned indigenous manufacturing firms such as Samsung, Hyundai, and LG. These firms were rewarded by the government for their export performance through subsidies, credit access, and sustained support through industrial policies and a dependable supply of qualified labor.

But this simple textbook explanation does not answer an important question: How did these companies continue to diversify their products and evolve their capabilities to reach the global technological frontier? The answer might hold the key for further diversification in aspiring economies driven by manufacturing exports.

Korea’s knowledge-enabled industrial diversification

Our recent analysis of export products and patents portfolio of 99 countries, including Korea, shows that the country’s development trajectory is characterized by a shift from production-based diversification to technology-based and complex diversification. While many developing countries remain captive to their natural endowments, Korea, early on, decided to produce new products that were distinct from its current production capabilities. The diversification of the export portfolio from raw material and agricultural products in the 1960s to heavy and chemical industries, shipbuilding, and electronics in the 1970s was made possible through strong policy drive, import substitution, and top-down planning (enabled by an authoritarian rule).

Middle-income economies often achieve significant diversification, but struggle with the transition to more knowledge-based products. These transitions usually require more than production experience and are accelerated by an upgrade of domestic technological and human capital capabilities.

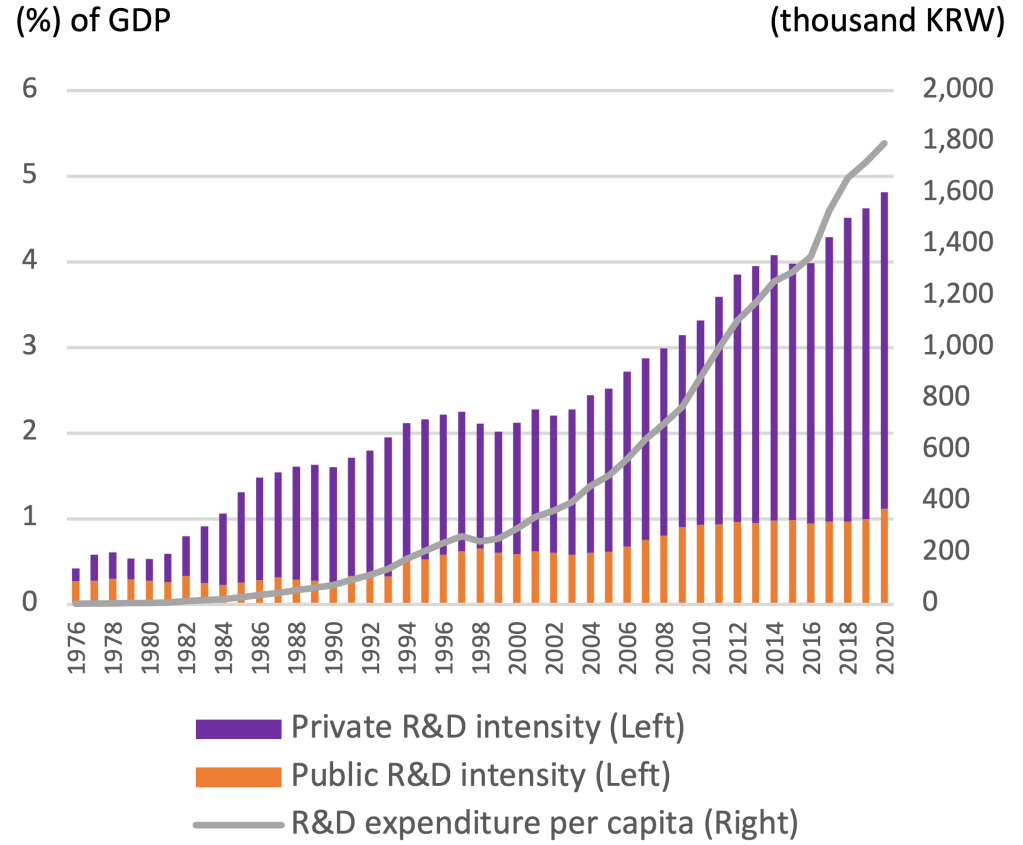

As Korea developed, its major knowledge source changed from imported knowledge to accumulated experience and knowledge within the country. Korea’s research and development (R&D) expenditures increased from a meager $46.1 million in 1976, to $70.4 billion in 2020 (Figure 1). The public-private shift is notable. In 1976, public spending on applied R&D in government research institutes (GRIs) constituted 72% of total R&D expenditures, but by 2020 the private sector accounted for 79% of R&D.

Figure 1. R&D investment in Korea

Source: Statistics Korea (KOSIS), National Science & Technology Information Service (NTIS)

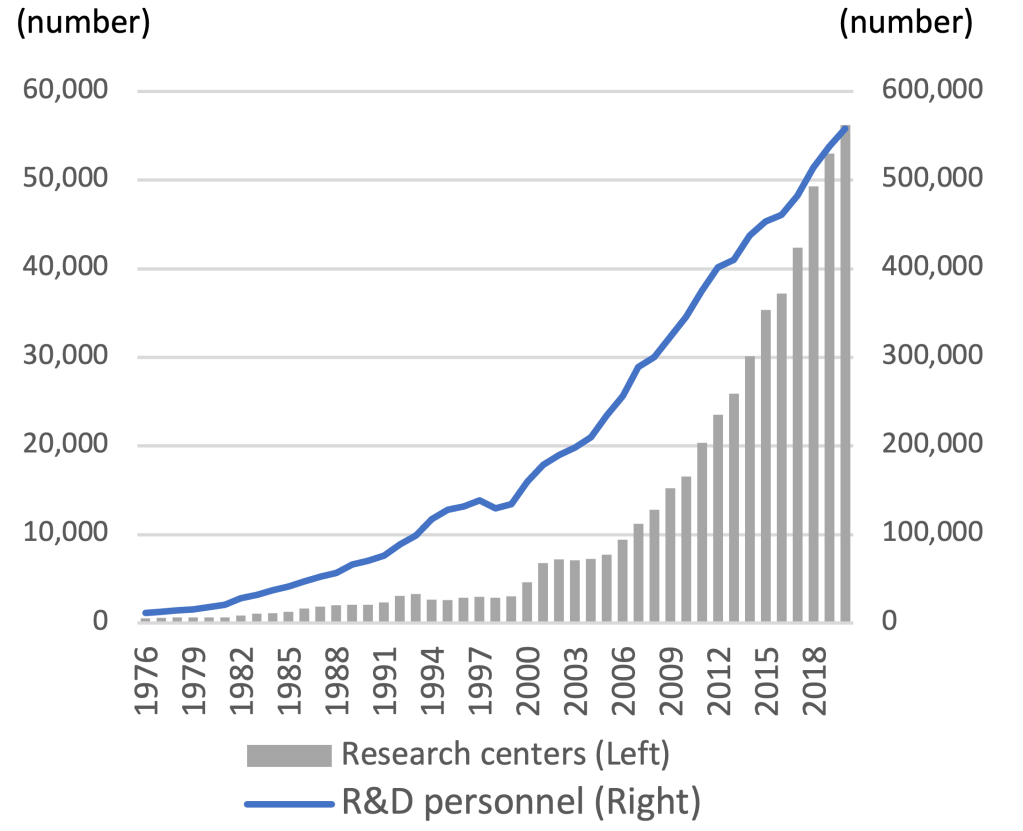

This rapid increase in private sector spending on R&D was promoted by the Korean government through direct and indirect policies. In the 1970s, the Korea Industrial Technology Association (KOITA) was formed to facilitate the establishment of private research centers. Moreover, manufacturing firms with annual revenues of over $25 million were encouraged to establish corporate research institutes, in part through tax exemptions on R&D expenses. In the early 1980s, the government allowed private R&D centers to participate in national R&D projects and eased the minimum requirements for establishing corporate R&D centers. The number of R&D centers in Korea increased from 567 in 1976 to 56,223 in 2020, and R&D personnel increased from 11,661 in 1976 to 558,045 in 2020 (Figure 2). Subsequently, Korea’s international patent applications increased from less than 2000 in 1970 to more than 235,000 in 2021.

Figure 2. Number of R&D centers and personnel in Korea

Source: Statistics Korea (KOSIS), National Science & Technology Information Service (NTIS)

Developing East Asia FDI-driven path of diversification

Developing East Asian economies have achieved a significant diversification of production, driven by sizable inflow of foreign direct investment (FDI). The net inflow of FDI in the East Asia and Pacific region increased sixfold over the last 20 years from $112 billion in 2002 to $688 billion in 2022. As a result, Vietnam’s value-added contribution to global value chains (GVCs) grew fast in various sectors (agribusiness, textiles, transport equipment, electronics/ICT equipment), and its product space expanded tremendously over the last 20 years. Similar trends could be observed in other FDI-attracting economies such as Malaysia, Thailand, Philippines, and Cambodia with varying differences. Indonesia’s trade openness has declined since the early 2000s and historical FDI inflows have been constrained by restrictions on foreign competition.

While product diversification has been largely FDI-led in developing East Asian countries, Korea’s was spearheaded by domestic manufacturing firms that were able to accumulate the know-how needed to transition from learning by doing (production) to learning by knowing (design and innovation) and increase the sophistication of their products.

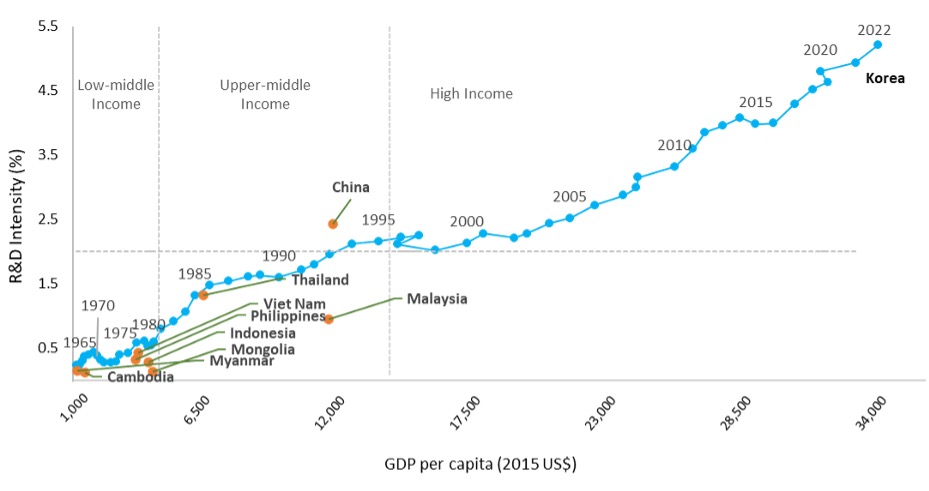

Compared to Korea, developing East Asian economies have been underinvesting in knowledge capabilities necessary to diversify into unrelated products and services that require more sophisticated and knowledge-based resources. As an example, Indonesia’s and Malaysia’s R&D intensity were at 0.28% and 0.95% in 2020, compared to Korea’s 0.61% in 1978 and 1.95% in 1993 when it was at a similar GDP per capita (constant 2015 U.S. dollar) (see figure 3 below). Despite the increase in patent applications in Vietnam since the mid-1990s, driven mainly by multinational enterprises, only 12.5% of patents filed with the National Intellectual Property Office were by Vietnamese residents in 2021; the rest were filed by non-residents from Japan, China, the U.S., and Korea. The question becomes, will these economies be able to continue to diversify their product portfolio without upgrading their domestic knowledge and technological capabilities?

Figure 3. R&D intensity versus GDP per capita, Korea and East Asian countries, 1965-2022

What does this mean for policymakers?

To accelerate the diversification into new core products, middle-income economies need to increase investments in technology and knowledge capabilities’ upgrading. In addition to securing production capabilities through FDI, emerging East Asian economies could deepen the innovation efforts of local firms, be it large incumbents or venture-backed startups, to further upgrade the capabilities of the domestic sector, increase its value contributions, and productivity growth. Recent firm-level analysis shows that East Asian frontier firms are not leading in productivity growth and identifies low levels of competition and lack of incentives to innovation as the key culprits.

The public sector has a key role in investing in the research infrastructure and increasing the supply of skilled labor from leading universities. Korea made such bold investments early on: It established the Korea Institute of Science and Technology (KIST) in 1966 as the first government-funded applied research institute and the Korea Advanced Institute of Science and Technology (KAIST) in 1971 as an industry-oriented university; both institutions are credited with providing the blueprints for the development of strategic industries and the necessary human capital. Public policy can also incentivize local firms to invest in R&D and upgrade their capabilities to participate in GVCs and leverage knowledge spillovers for further learning. These policy efforts need to be coordinated, most importantly, industrial and innovation policies need to be aligned and continuously evolve to achieve the ultimate objective of becoming high-income—an uphill path necessarily traversed through continuous and all-encompassing learning.

-

Footnotes

- Republic of Korea (Korea, hereafter)

Commentary

Exploring Korea’s product diversification model: Insights for developing East Asia

May 1, 2024