ROV Market Share To Rise by USD 6.2 Billion By 2033, Growing at a CAGR of 11.0%

ROV Market size is expected to be worth around USD 6.2 billion by 2033, from USD 2.2 billion in 2023, growing at a CAGR of 11.0% from 2023 to 2033.

NEW YORK, NY, UNITED STATES, January 27, 2025 /EINPresswire.com/ -- Report Overview

The global Remotely Operated Vehicle (ROV) Market is experiencing a significant expansion driven by its increasing applications across diverse industries such as oil and gas, military and defense, scientific research, and underwater constructions. ROVs are unoccupied, highly maneuverable underwater robots operated by a crew aboard a vessel. They are equipped with cameras, sensors, and tools that allow them to perform complex tasks in deep-water environments that are otherwise inaccessible or dangerous for humans.

Historically, the oil and gas industry has been the primary user of ROVs, employing these sophisticated machines for drilling support, maintenance, and repair of subsea infrastructure, pipeline inspections, and offshore developments. The downturns in oil prices often influence market dynamics, as oil companies' investment capacities affect ROV deployment rates. However, the market has shown resilience, adapting to the cyclical nature of the oil and gas industry with innovations that enhance efficiency and reduce operational costs.

The military and defense sector also presents substantial opportunities for the ROV market. These vehicles are crucial for mine countermeasures, harbor security, and recovery missions, serving as a safer alternative to divers. The escalating focus on maritime security, alongside increasing spending in defense budgets globally, underscores the growing demand for advanced, reliable underwater surveillance solutions.

In addition to these traditional sectors, scientific research and environmental monitoring are burgeoning areas of application for ROVs. Scientific institutions utilize these vehicles to study marine biology, geology, and oceanography, helping to advance our understanding of deep-sea ecosystems and their global environmental impact. The push towards environmental sustainability and the need for regular monitoring to assess the health of underwater environments further propel the adoption of ROVs.

Driving factors for the ROV market include technological advancements in navigation systems, propulsion, and imaging technologies. These enhancements not only improve the operational capabilities and efficiency of ROVs but also reduce the cost and complexity of underwater operations, making them accessible for more applications. Moreover, the increasing emphasis on deep-sea minerals and the potential of underwater mining activities are expected to open new avenues for the ROV industry.

Looking ahead, the ROV market is poised for robust growth, driven by the expansion of offshore wind farms, rising investments in oceanography, and increasing underwater exploration activities. The development of autonomous underwater vehicles (AUVs) and hybrid systems that combine the capabilities of both AUVs and ROVs could further revolutionize the industry, offering enhanced functionalities and operational flexibility. Furthermore, emerging markets in Asia-Pacific and Africa, with their ongoing maritime and infrastructural developments, are anticipated to provide significant growth opportunities for the ROV market.

As the industry continues to evolve, market participants will need to focus on innovation, cost management, and strategic partnerships to capitalize on emerging opportunities and navigate the challenges of an increasingly competitive landscape. The global ROV market, with its critical role in supporting the sustainable and secure use of ocean resources, stands at the forefront of technological advancements that promise to reshape industries and foster a new era of economic development in marine environments.

𝐂𝐮𝐫𝐢𝐨𝐮𝐬 𝐚𝐛𝐨𝐮𝐭 𝐭𝐡𝐞 𝐜𝐨𝐧𝐭𝐞𝐧𝐭? 𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐚 𝐬𝐚𝐦𝐩𝐥𝐞 𝐜𝐨𝐩𝐲 𝐨𝐟 𝐭𝐡𝐢𝐬 𝐫𝐞𝐩𝐨𝐫𝐭: https://market.us/report/rov-market/free-sample/

Key Takeaways

• The global ROV Market size is expected to be worth around USD 6.2 billion by 2033, from USD 2.2 billion in 2023, growing at a CAGR of 11.0% during the forecast period from 2023 to 2033.

• In 2023, Work-Class ROVs maintained a significant presence in the market, holding over a 42.4% share.

• In 2023, ROVs in the 100 – 200 HP range held a dominant market share, prized for their balance of power and agility.

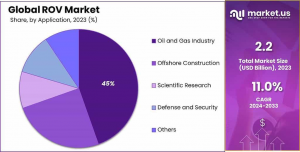

• In 2023, the Oil and Gas Industry retained a dominant market share of over 44.6%.

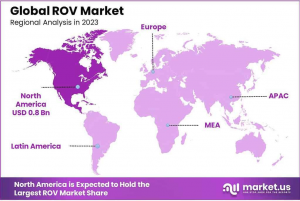

• North America emerged as the most lucrative market in the global ROV industry in 2023, capturing the largest revenue share of 37.2%.

ROV Top Trends

1. Integration of Artificial Intelligence and Automation: ROVs are increasingly incorporating AI and automation technologies, enhancing their capabilities for repetitive tasks like inspections and surveys. This reduces the need for continuous human oversight and improves efficiency in operations.

2. Advanced Applications in Underwater Mining and Military: There's a growing interest in using ROVs for underwater mining due to the demand for deep-sea minerals. Military and defense applications are also expanding, with ROVs being employed for tasks like underwater surveillance and mine detection.

3. Expansion in Environmental Monitoring: ROVs are being used more for environmental monitoring tasks, such as assessing the health of marine ecosystems and coral reefs. This is due to heightened global emphasis on environmental sustainability.

4. Challenges with Regulatory Compliance and Operational Conditions: ROVs face challenges such as compliance with strict environmental and safety regulations, operational limitations in harsh underwater conditions, and high initial costs that can hinder broader adoption.

5. Growth in Deep-Sea and Offshore Operations: The need for ROVs in deep-sea exploration and offshore oil and gas operations is increasing. Technological advancements in ROV capabilities allow them to operate effectively at greater depths, supporting complex tasks like the installation and maintenance of subsea infrastructure.

Key Market Segments

By Type

In 2023, Work-Class ROVs maintained a significant presence in the market, holding over a 42.4% share. These vehicles are preferred for complex underwater tasks such as support for drilling, heavy lifting, and construction activities at considerable depths, where their robust capabilities are crucial. Work-class ROVs are integral to major offshore oil and gas operations, valued for their durability and advanced technological features that ensure precision and reliability under extreme conditions. Inspection-Class ROVs, which are smaller and more agile, are mainly utilized for routine inspections and maintenance.

Observation-Class ROVs, known for being smaller and more affordable, cater to activities like scientific research, environmental monitoring, and educational purposes. Their user-friendly operation and deployment make them popular among research institutions and smaller commercial enterprises, supporting varied applications from coral reef observation to underwater wildlife studies. Other specialized ROVs serve niche roles, such as military reconnaissance or specific scientific research, tailored to unique operational demands and often equipped with advanced technology to perform complex tasks beyond the scope of standard ROVs.

By Depth Rating

In 2023, shallow-water ROVs dominated the market, instrumental in coastal engineering, underwater archaeology, and environmental assessments. Designed for less challenging conditions, they are suited for a variety of applications, from bridge pier inspections to marine biological studies, offering versatility and cost-efficiency that attract smaller enterprises and research entities. Midwater ROVs are designed for intermediate depths and are commonly employed in industries like oil and gas for pipeline inspections and maintenance. Their build allows them to manage moderate underwater currents and pressures, suitable for a range of tasks requiring more durability than shallow-water ROVs but not the high-end specifications of deepwater operations.

Deepwater ROVs are specialized for extreme depths and pressures, essential for deep-sea exploration and advanced scientific research. They are primarily used in offshore oil and gas operations for ultra-deepwater drilling and development activities. Their sophisticated technology and high cost make them vital for executing complex missions underwater. The differentiation of ROVs based on depth rating reflects the diversity of applications and environments in which these vehicles operate. Ongoing advancements in ROV technology tailored to various depth conditions are expected to enhance market segmentation and specialization.

By Power

In 2023, ROVs in the 100 – 200 HP range held a dominant market share, prized for their balance of power and agility. These mid-range ROVs excel in underwater tasks such as medium-load material handling, salvage operations, and complex construction tasks in the offshore oil and gas sector. Their power capacity supports extensive operational capabilities, yet they remain more maneuverable and cost-effective than higher HP models. ROVs with up to 100 HP are ideal for lighter, precision tasks like underwater inspections, environmental monitoring, and scientific research. Their smaller size and reduced power output suit operations in confined or sensitive environments, where precision and minimal disturbance are paramount. These models are also more accessible to smaller entities and educational institutions due to lower operational and maintenance costs.

ROVs with more than 200 HP are engineered for heavy-duty tasks requiring substantial thrust and power, such as deep-sea drilling support, heavy underwater construction, and demanding salvage operations. Their robust construction and high power output allow them to handle heavier loads and operate advanced equipment at great depths, essential in large-scale industrial and exploration activities. Each power category of ROVs serves distinct operational needs across various underwater environments, reflecting their specialized applications and the diverse demands of the ROV market. As technology evolves, the efficiency and capabilities of ROVs across all power ranges are expected to improve, further cementing their crucial role in marine operations.

By Application

In 2023, the Oil and Gas Industry retained a dominant market share of over 44.6%. ROVs are indispensable in this sector for tasks such as underwater drilling support, pipeline inspection, and maintenance, thriving in harsh, deep-water environments where human divers cannot operate safely or economically. Their significant contribution ensures the operational integrity and efficiency of offshore oil and gas infrastructures. Offshore Construction is another principal application for ROVs, vital for installing underwater structures, laying cables, and performing seabed preparation tasks. The rising demand for renewable energy sources, like offshore wind farms, increasingly relies on ROVs for these complex construction activities at sea.

For Defense and Security, ROVs are strategically important in mine countermeasures, harbor surveillance, and underwater recovery missions, performing high-risk or intricate tasks more safely than human divers, thus becoming key assets for naval forces and security agencies. Other applications span sectors like aquaculture, where ROVs assist in maintaining fish farms, and water treatment, where they inspect and repair underwater infrastructure. The versatility of ROVs underlines their value across a broad spectrum of industries, with their usage and market demand expected to grow as their capabilities enhance.

𝐃𝐢𝐫𝐞𝐜𝐭𝐥𝐲 𝐏𝐮𝐫𝐜𝐡𝐚𝐬𝐞 𝐚 𝐜𝐨𝐩𝐲 𝐨𝐟 𝐭𝐡𝐞 𝐫𝐞𝐩𝐨𝐫𝐭 - 𝐒𝐚𝐯𝐞 𝐚𝐬 𝐌𝐮𝐜𝐡 𝐚𝐬 𝟑𝟎%! https://market.us/purchase-report/?report_id=120206

Key Market Segments List

By Type

• Work-Class ROVs

• Inspection-Class ROVs

• Observation-Class ROVs

• Others

By Depth Rating

• Shallow Water ROVs

• Midwater ROVs

• Deepwater ROVs

By Power

• Upto 100 HP

• 100 – 200 HP

• Above 200 HP

By Application

• Oil and Gas Industry

• Offshore Construction

• Scientific Research

• Defense and Security

• Others

Regional Analysis

North America emerged as the most lucrative market in the global ROV industry in 2023, capturing the largest revenue share of 37.2%. The region's market potential is propelled by increasing investments in offshore oil and gas exploration and significant advancements in underwater robotics technology. The demand for ROVs in North America is driven by the need for deepwater exploration, inspection, construction, and repair activities. The strong maritime and defense sectors in the US and Canada also significantly contribute to the market's growth.

The US and Canada are leading in the production, export, and use of ROV technology, with about 61% of global ROV deployment for underwater exploration attributed to North America, as reported by Marine Technology in April 2024. North America's focus on developing innovative underwater technologies and the increasing adoption of automation and robotics in marine research and commercial applications are key factors influencing the global ROV market production during the forecast period.

Regulations On the ROV Market

1. EU Emissions Trading System Inclusion: Starting in 2025, large ships operating in EU ports must monitor and report their emissions. This is part of integrating maritime shipping into the EU's Emissions Trading System, pushing shipowners to adopt cleaner technologies and fuels to lower their emissions.

2. FuelEU Maritime Regulation: Also effective from 2025, this regulation sets strict limits on the greenhouse gas intensity of the fuels used by ships. It aims to promote the use of sustainable and alternative fuels. Non-compliance could lead to penalties, incentivizing shipowners to switch to greener options.

3. Hong Kong Convention on Ship Recycling: Coming into force in June 2025, this convention mandates that ships must be recycled in a manner that does not endanger human health or the environment. Shipowners are required to maintain an Inventory of Hazardous Materials and ensure recycling at authorized facilities.

4. Maritime Security Enhancements: 2025 will see stronger measures to prevent fraudulent ship registrations and improve port inspections. This aims to mitigate risks from the 'dark fleet'—vessels that operate outside of international safety regulations.

5. IMO Carbon Intensity Indicator (CII): The International Maritime Organization will enforce new regulations assessing ships based on their carbon emissions per cargo capacity and distance traveled. Poorly rated ships could face operational restrictions, compelling owners to improve energy efficiency.

Key Players

• Oceaneering International, Inc.

• Saab Seaeye Limited

• TechnipFMC plc

• Subsea 7 S.A.

• Forum Energy Technologies, Inc.

• DOF Subsea AS

• ECA Group

• Fugro

• Deep Ocean Group

• Blue Robotics, Inc.

• Ocean Infinity

• Ocean Aero

• Kongsberg Maritime AS

• Atlas Elektronik GmbH

• Aquabotix Technology Corporation

Conclusion

The Remotely Operated Vehicle (ROV) market is set to experience sustained growth, driven by the expanding applications across various sectors including offshore oil and gas exploration, scientific research, and environmental monitoring. Technological advancements in ROV capabilities are enhancing their operational efficiency and enabling their deployment in increasingly challenging environments. As industries continue to demand more complex underwater explorations and interventions, the versatility and advanced functionalities of ROVs are becoming increasingly critical.

Lawrence John

Prudour

+91 91308 55334

Lawrence@prudour.com

Distribution channels: Energy Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release